Vid Hribar

Strategic Partnerships and Ecosystems Manager

Blockchain Hub, Raiffeisen Bank International AG

One of the most notable applications of blockchain technology is tokenization. Tokenization involves representing ownership of an asset on a distributed ledger, known as the blockchain, with tokens serving as the units of ownership. The potential for tokenizing a wide range of assets is vast, including financial instruments like bonds and stocks, commodities, currencies, art pieces, and even intellectual property rights. But what exactly are the advantages of representing ownership on the blockchain? Let’s explore the main reasons.

Faster and Cheaper Transactions: One of the core promises of blockchain technology is eliminating intermediaries. With fewer parties involved, transactions become more efficient, both in terms of speed and cost. By reducing the number of intermediaries, blockchain also minimizes the need for record reconciliation, resulting in streamlined processes.

Programmability: Tokenizing assets on the blockchain goes beyond mere recording of ownership. Assets can be programmed, enabling automation and eliminating manual processes. For example, interest distribution for bonds can be automated through smart contracts. Even if an asset is transferred to another party, its programmed characteristics remain intact, ensuring a seamless transition.

Fractionalized Ownership: Traditionally, many assets were accessible only to wealthy investors who could afford large investment sums or outright purchases. Tokenization introduces a standardized procedure that allows assets to be divided into smaller, more manageable portions. This fractionalization opens up previously exclusive markets to a broader range of investors.

Increased Liquidity for Niche Markets: Fractional ownership not only enables more investors to access previously limited asset classes, but it also potentially enhances liquidity. With the option to sell tokens on secondary markets, previously illiquid assets can gain greater marketability. This liquidity boost creates new opportunities and unlocks potential value for both investors and asset holders.

Tokenization also offers additional benefits such as greater transparency (while ensuring privacy) and the emergence of new business models. For example, tokens can be used as collateral for loans, opening up innovative financing options. It is important to note that the value proposition and benefits of tokenization vary across different asset classes.

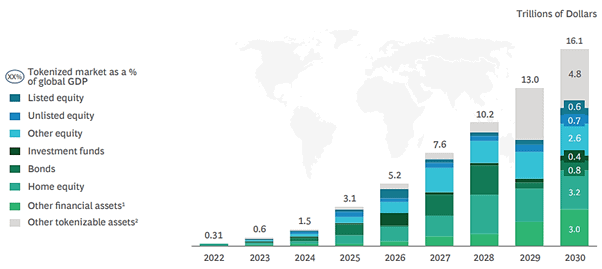

While tokenization is still an emerging field, market studies predict substantial growth in the digital assets market. By 2030, the market size is expected to reach approximately EUR 16 trillion, representing about 10% of global GDP. Although cryptocurrencies are currently dominating the crypto asset market, tokenized assets are predicted to surpass them in the next five years.

Tokenized market as % of global GDP in USD

A significant indicator of this growing field is the surge in venture capital investments. In 2021 alone, investments in tokenization and its underlying infrastructure (custody, tokenization platforms, etc.) reached USD5.5 billion. The majority of these investments was made in US companies, with Europe following in second place.

The upward trend in tokenization is expected to continue. Regulation plays a crucial role in driving this growth, as it provides a framework for investment products. The recently passed European Markets in Crypto Assets (MiCA) regulation, applicable next year, sets rules for the issuance of certain crypto assets and regulates crypto service providers. While not comprehensive, it represents a positive step forward, especially when compared to regulations in other countries. Germany stands out as an advanced jurisdiction due to its favorable regulations, which have fostered a fast-growing tokenization ecosystem.

The trend of digitization and process optimization also contributes to the growth of tokenization. Studies indicate that end-to-end processes for tokenized bonds can be up to 60% (!) more efficient than current processes. Additionally, investors are actively seeking new opportunities, and tokenization offers a cost-efficient approach, allowing investment in previously unavailable asset classes.

However, tokenization is still in its early stages, and several challenges need to be overcome before it becomes mainstream. These challenges include the lack of international standards for technology and regulation, limited stakeholders in the ecosystem, and the predominance of pilot projects over fully operational ones. Time, agreement on standards, and increased education for investors are necessary for tokenization to reach its full potential.

Blockchain’s distributed nature has rendered many intermediaries redundant. In our next article, we will delve into what tokenization means for banks and their role in a distributed system.

Stay tuned for more insights: this article is the first of two on the topic of tokenization. In the next article, we will explore what tokenization means for the financial industry and what are the possibilities for engagement.